Using tax wrappers to structure your investments in a tax efficient manner as a resident of Italy

Italy is commonly regarded as high-tax jurisdiction which makes it important to look for tax efficient ways to manage your financial planning. One popular solution for Italian residents with investment assets is to use a compliant tax wrapper as a vehicle for managing long-term investments.

Many who move to Italy assume that leaving investment assets in their country of origin is preferable to navigating and trusting the Italian banking system. However, there are a few important downsides to this approach.

We have identified three main problems in leaving your investments overseas as an Italian resident:

Firstly, you are also responsible for reporting capital gains and dividends on each individual asset. These gains are again declared via your annual return and the taxes must be paid whether you have withdrawn money from your investments or not.

Secondly, they are subject to IVAFE which is the wealth tax of 0.2% on overseas financial assets and must be paid annually.

The third problem is that the actual reporting process to declare capital gains and dividends is quite complicated. The only way to ensure avoiding mistakes is to work with a commercialista (accountant) which adds to costs in terms of both time and money.

Italian compliant tax wrappers can avoid these issues as well as allowing for significant tax benefits and a suitable vehicle to hold investments in a secure structure outside of Italy.

These structures are typically used by high net worth Italians and are technically classed as unit-linked life insurance bonds. In order to be compliant the insurance company must have a branch in Italy and the authority to act as a withholding agent for Italian taxes.

Under this structure Italian resident policyholders are entitled to the following benefits:

- Deferred income and capital gains tax. Changes to assets within the portfolio are not chargeable events and thus taxes which would be withheld from a direct investment remain invested within the policy, while losses on other assets are offset against capital gains liabilities, providing what is known as gross roll up.

- No inheritance tax liability for beneficiaries.

- Policy is considered an Italian financial asset and therefore not subject to IVAFE. Stamp duty does apply but is withheld and paid on your behalf when withdrawals are made.

- Tax efficient method of taking withdrawals, so can be used effectively to provide regular income in retirement.

- Convenience of no tax reporting obligations as the Insurance company acts as a tax withholding agent and completes the necessary reporting to the Italian authorities for client

- Security of assets – using a custodian banking arrangement the assets do not appear on the balance sheet of the insurance company or custodian bank and your assets remain intact in the case of insolvency.

- Investment flexibility – open architecture with ability to appoint overseas investment management firms

- Freedom to appoint beneficiaries who are not legal heirs and to determine the amounts available to beneficiaries (rather than standard Italian probate). Beneficiaries can also be changed at any time.

- Policy benefits cannot not be seized by the Italian authorities.

- Possibility to add additional insurance coverage on investment loses, to protect beneficiaries if used for inheritance tax planning.

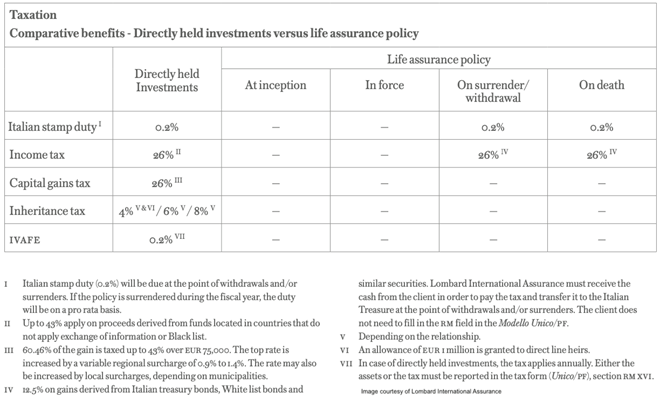

The taxation table below shows the comparative benefits of using an Italian compliant insurance bond in comparison with directly held investments for an Italian resident.

In conclusion, there are substantial benefits above tax efficiency. Both the convenience and security factors are important for Italian residents, where tax and banking arrangements can be both complicated and not as secure.

The tax efficient manner in which regular withdrawals can be taken makes these structures a perfect solution for retirees who have built up invested assets which they intend to use for an income.

As the open architecture allows an investment manager to be appointed to manage the portfolio within the bond we look to UK based managers to offer a wide range of options to our clients.

Finally, a word of warning when it comes to dealing with financial advisors who promote these products: unfortunately life insurance bonds are often used to disguise large commissions both by Italian banks and insurance brokers in Italy who sometimes market themselves as international financial advisers.

If there is a surrender penalty then there is a commission built into the structure. This commission results in much higher fees over the term of the policy (indemnified by the surrender penalty) that will significantly reduce your investment returns.

As we are part of a UK based group of fee-based financial advisers we can provide these structures with no penalties on surrender or withdrawal because no hidden commissions are present, and as such we also offer them at a comparatively much lower cost.

Please get in touch via the contact form below for more information or to arrange a free initial consultation.